Giacomo Mergoni – Banor Capital Ceo – signs the editorial on the italian financial market published on the Swiss website Lamiafinanza.ch.

Read the full article below.

LUGANO FUND FORUM – FOCUS 21/11/2014

Italy: an opportunity to grasp, with the right approach

Through alternative (long/short) UCITS, investors can look to a market like Italy’s from a value perspective to gain access to any gains and at the same time reduce losses during periods of reversal.

by Giacomo Mergoni [CEO of BANOR Capital Ltd]

The Italian economy is entering its 4th consecutive year of recession. The Renzi government, in power since March 2014, is seeking – with some difficulty – to tackle the major structural problems that are weighing down an economic system otherwise characterised by entrepreneurial liveliness, creativity and talent. The country needs to regain competitiveness through reforms of the institutions, the judicial system and the labour market and by streamlining its bureaucracy.

A number of important reforms have already been initiated, while others struggle to get under way, given the strong pressure exerted by established interest groups in the country’s economic fabric. The progress of the reforms (which can be monitored in real time on the passodopopasso.italia.it website) is the real unknown quantity weighing on the timescale for the Italian economic recovery.

In the meantime, the financial markets are looking ahead and have already taken into account some of the good news that could be on the way. After the very poor performance of 2010 and 2011 (down 11.49% and 24.29% respectively), the Italia All-Share FTSE Index recovered part of the losses in 2012 and 2013 (with gains of, respectively, 8.36% and 17.63%). 2014 has been a highly volatile year. The index started well, achieving 17% in June, only to fall to -5% in October. By mid-November the index had gained 1% on the start of the year.

Although an opportunistic, passive approach (market timing with the use of ETFs, for example) is never easy to implement, these last 5 years have severely tested even the most stubborn supporters of this style of investment. Many investors, especially foreign ones, have thrown in the towel and turned their backs on a country that we, however, view as still being full of opportunities, especially at these valuation levels. Following the long period of very poor results (car and house sales down 35% from the long-term average, advertising spending at a historic low with respect to GDP), the Italian market today is at one times net worth and only 10.6 times projected earnings (Shiller PE).

Looking to the present, but with one eye to the future, we can, however, cite several reasons for optimism. The euro/dollar exchange rate is finally less punitive for Italian exporters; the cost of raw materials has fallen and is helping Italy’s many “transformers”; consensus expectations are at historic minimum levels; and the above-mentioned reforms are restoring optimism to the economy.

It is at times like these that an investor taking a value approach seeks long-term winners: companies with sound business models, a competitive advantage, high cash generation and conservative valuation. For those who can take advantage of them, advantageous short opportunities are also available: over-valued companies with unsustainable business models and margins, whose negative outlook has not attracted the market’s attention. We at BANOR Capital, however, feel that alternative (long/short) UCITS funds are the right instrument for investors to approach a market like the Italian one.

A well-managed long/short fund that adopts a value approach can give investors access to any gains in the Italian market and at the same time reduce losses in periods of reversal. In the United States too, the statistics (FactSet 30 June 2014) show that long/short strategies have the best risk/return profile of all the alternative strategies. One of the features in long/short funds’ favour is, indeed, the possibility of making effective and swift adjustments to net exposure to the stock market.

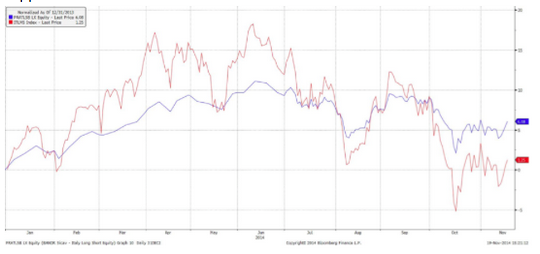

Let’s take, for example, the performance of our Italy Long/Short strategy, which has been active since January 2009: first as an offshore hedge fund and then, since 2010, as BANOR SICAV – Italy Long Short Equity. In nearly 6 years we have obtained a return of 53.4%, against a market return of 10.7%. The volatility of the strategy equated to 11%, compared with 22% for the market, in line with an average net exposure of 47%. If we then take a more recent period, from the start of 2014 to mid-November, the BANOR Italy Long Short fund gained 4.80% compared with 1.13% for the FTSE Italy All-Share Index. But that’s not all: in June, the market gained 17% and in October lost 5% (relative performance -19%). On the same dates, our fund was earning 10% and 1% (relative performance -8%).

The graph below explains more clearly what happened

This performance, like that of the past, was obtained through serious and painstaking fundamentals analysis of Italian and world-leading companies in the sectors we know best (energy, luxury goods, media, consumer goods, industrial, telecoms, utilities, financials). Using our models, we establish what we consider to be the right valuation for each company we study. If this diverges markedly from the market valuation, we decide whether to take a long or short position on the stock. We tend to have a more concentrated long portfolio and a more diversified short one, to mitigate the risk of potentially infinite losses if the over-valued stocks on which we go short were to continue to rise.

The arithmetic sum of long minus short investments determines the net exposure of our portfolio, which we use as a third instrument to interpret our view of the market. In 2014, for example, we reduced our net exposure from 50% in April to 40% in June, when we felt that the market had overheated. After the June-August adjustment (-15% for the index, -6% for the fund) we stayed in the low part of our net exposure range, to then again increase our exposure to over 50% after the September and October adjustments, in which the market lost more than 15%.

The contents provided for in this section have not been audited by independent bodies. There’s no warranties, expressed or implied, regarding reliability, accuracy or completeness of the information and opinions contained. The informations provided are not based on assessment of the adequacy and do not consider the risk profile of the possible recipients, and therefore, should not be construed as personal recommendation and does not constitute investment advice. The contents of this site may not be reproduced and/or published whole or in part, for any purpose, and/or disclosed to third parties.