Luca Riboldi and Tomaso Mariotti interviewed on the Absolute Return Funds: Absolute Return Bond Funds set to perform well, even with rising rates.

Read the full article here below.

Absolute return bond funds set to perform well, even with rising rates

The analysis of alternative fixed income funds spotlights the high allocation of American bonds, but with a relatively limited duration

By Luca Damiani

After delaying the change of direction for its monetary policy, for the Federal Reserve the time at last seems ripe to gradually raise interest rates. In Europe, however, deflation has prompted the European Central Bank to launch its first quantitative easing (QE) plan, thus implying that rates will remain low for some time to come. Today more than ever, these divergent macroeconomic contexts require a flexible approach to bond investments, using a strategy that can benefit from both increases and decreases in interest rates.

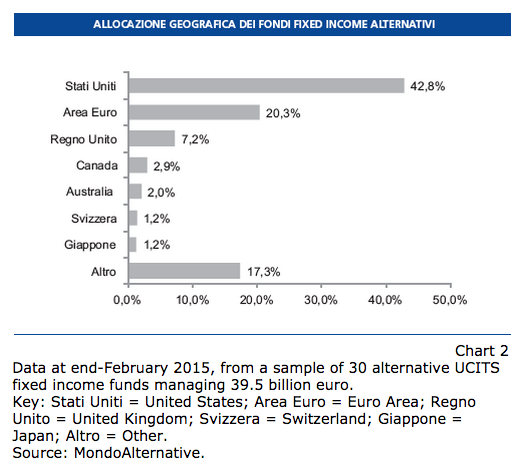

MondoAlternative has conducted a survey of fixed income absolute return funds, market leaders in alternative UCITS products with 41.7 billion euros under management and a market share of 25.4% at the end of January 2015 (see chart 1), to observe in detail their positioning at country, sector and credit rating level. The picture that emerges shows a higher exposure to American fixed income securities, a significant use of structured products (such as asset-backed securities (ABS), mortgage-backed securities (MBS) and collateralized debt obligations (CDO)) and about 1/3 of the “typical” portfolio composed of AAA bonds.

ASSETS AND FUNDING FROM ALTERNATIVE UCITS FIXED INCOME FUNDS

Only the strong dollar can cause the timing of the Fed’s moves to slip

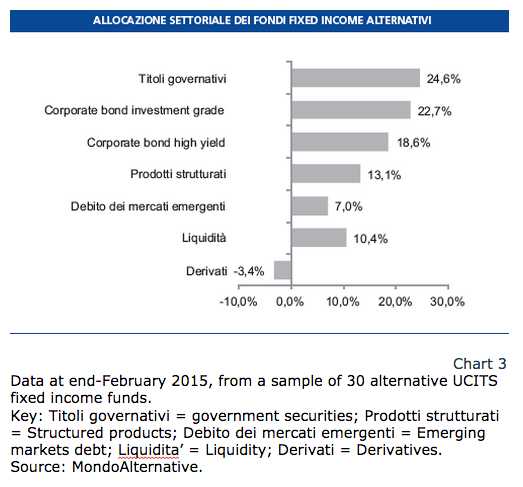

The survey, conducted on a sample of 30 funds managing assets amounting to 38.5 billion euro at the end of February 2015 and managed by 23 asset management companies, highlighted the geographical distribution of alternative fixed income products. The highest share is found in the American bond market (42.8%, see chart 2), followed by European bonds (20.3%). Lower values were found for the United Kingdom (7.2%), Canada (2.9%), Australia (2%), Switzerland and Japan (both 1.2%), while a high percentage of the remaining allocation (17.3%) refers to the Asian countries and emerging economies in Latin America, Africa and the Middle East.

As regards US monetary policy, Daniel Hartmann, senior economist at Bantleon, says he expects “the Fed to start raising rates in June, with the Fed Fund target rate rising from 0/0.25% to 0.25/0.5%, to then reach 1% in December 2015”. Hartmann sees no unexpected changes of direction on the horizon. “From our point of view, it’s very unlikely that the American monetary fund will continue its ‘wait-and-see’ policy. With an average growth of around 3% and a labour market showing strong expansion, when, if not this year, should the Fed start to reduce its enormous monetary stimulus?”. However, Luca Riboldi, chief investment officer at Banor Sim, takes another view. “If the dollar maintained its current strength and the American economy were to slow to less than 2.5% GDP growth by the end of the second quarter of 2015, then perhaps the expected increase in US rates could slip until 2016, or not take place at all”.

GEOGRAPHICAL ALLOCATION OF ALTERNATIVE FIXXED INCOME FUNDS

Martin Harvey, co-manager of the Threadneedle (Lux) Global Opportunities Bond fund, does not hide his concerns over the future performance of the dollar. “The factor that’s complicating the situation for the Fed is the strengthening of the dollar, which will keep inflation under control and produce a restrictive monetary policy, to which should be added the low oil price. We therefore expect rates to begin rising from this year, although possibly not as early as June. However, considering that the Fed has been very clear in linking its moves to labour market and pay rise indicators, the latest good figures on the employment front could increase the chances that the first rise will take place in the summer. At present, there’s a significant disconnect between the Fed’s aggressive internal forecasts on rates and those implied by market evaluations, and for this reason we’re monitoring the situation very carefully”, observes Harvey.

Euro area bonds: quantitative easing and rates below zero

On the recent developments in the European bonds market, Riboldi points out that “the most virtuous countries’ rates are negative up to five-year maturity dates because investors still fear deflation. As long as they can put their money in a safe place, they are willing to pay a premium. The problem isn’t European but global: if deflation is defeated, it will be defeated globally and so we won’t have a European problem. However, I believe it’s still too soon to say if the central banks will win their battle”.

In addition to the fears of deflation, Harvey explains that “another factor driving negative rates is the ECB’s bond purchase programme. Based on our estimates, the amount of resources this will absorb is several times higher than the euro area’s annual net government securities issues”. Harvey continues: “Considering that returns were already extremely low before QE was announced, it was inevitable that the short-term yields of the ‘safest’ countries would be driven into negative territory. The experience of the first week of QE in Europe perhaps highlights its added value in a context of negative interest rates, since investors and banks, now forced to pay to maintain cash, rushed to find positive returns along the rates curve”.

According to Hartmann, “the ECB’s bond acquisition programme, which envisages purchases amounting to 600 billion euro by the end of 2015, of which 400/450 euro in government bonds, will be implemented in full and without changes, even after the expected improvement in the economic picture in Europe”.

The major concern now is linked to the risk that the downwards trend in inflation forecasts will lead to a worsening of the deflation spiral and, in Europe, to a situation similar to that of Japan. “the European situation is not simply comparable to Japan’s, it’s exactly the same. Since February returns on 10-year German bonds have been lower than on Japanese bonds (0.26% compared with 0.40%). And French rates are at the same levels”.

But Harvey confides he expects pleasant surprises from European growth: “in our opinion, Europe is not fated to follow in Japan’s footsteps, and the latest data seem to confirm that. We expect GDP growth of 1.5% this year – which, based on recent European standards, is an extremely positive result.

In our opinion, the fact that the ECB’s bond purchase programme could have a direct impact on the real economy is debatable, given that bond yields were at very low levels even before QE was announced. But its effect in weakening the single European currency will lead to undoubted benefits for exporting firms, although this has happened in a context where many currencies have lost value against the American dollar. We therefore see a risk that the progress on the economic data front could hinder the full implementation of European QE, because of the strong German opposition”.

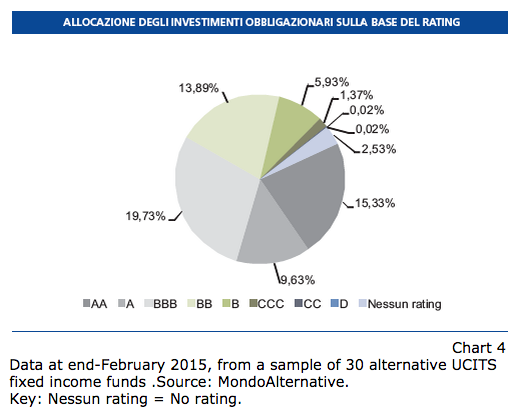

SECTOR-BASED DISTRIBUTION OF ALTERNATIVE FIXED INCOME FUNDS

The need for new products in the world of bonds

The new scenario taking shape on the bonds market is, therefore, one of divergent forces – rising rates in the United States and falling rates, and even negative values – in the euro area, with the emerging countries having to manoeuvre between these two opposing positions. The possibility of generating alpha ratios for traditional long-only funds today is, it seems, being sorely tested. This has led several management firms to launch innovative products which, uncoupled from any benchmark, manage duration dynamically to draw profits from any movement in bond quotations.

“Because of the low level of coupons for nearly all fixed-income segments, there is no longer any protection against losses in the event of rates rising”, observes Stephan Kuhnke, Bantleon CEO. “Against this background, managers must have the possibility of reducing the duration of portfolios, even to zero. From our perspective, however, it is not advisable to go negative on duration, since that produces a low return adjusted for risk as an effect of the steep yield curve. That is why we recommend that investors should adopt an opportunistic approach to stock market exposure in an equity overlay management process. To ensure that the risk profile is compatible with a portfolio made up exclusively of bonds, however, instruments for in-depth monitoring of the risks are vital”, explains Kuhnke.

Harvey emphasises the change currently taking place: “The starting level for rates today implies that the yields from which investors have benefited in recent years can no longer be repeated in the immediate future. This is not an opinion but a mathematical question. Long-only benchmarked funds will inevitably suffer as soon as the first rate rises appear. That is why investors must pay attention to strategies that could produce positive results, even when rates do rise. A negative duration is just one of the instruments that can be used, but investors should consider other sources for good performance, such as asset allocation and currencies”.

According to Tomaso Mariotti, advisor for the Banor Sicav Euro Bond Absolute Return fund, “the current situation of zero, or even negative, rates should favour absolute return products and cause problems for traditional long-only bond funds, at least those with a specific focus on government securities and higher-rated investment-grade bonds. Once the ECB brings an end to the ‘QE effect’, and we start to see rising yield curves in some geographical areas, the United States first and foremost, the risk of obtaining negative yields is a concrete one.

This fear should lead investors to look to absolute return products for their capacity to be short in duration and act from both buying and selling positions. The type of absolute return strategy needs to be clarified, however. This could involve traditional long-short strategies on credit or other investment areas not strictly linked to the bond market, such as volatility or exchange rates which, in the event of mistaken assumptions, can lead to steep capital losses”.

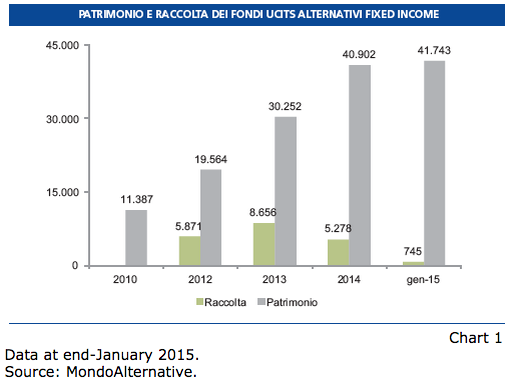

ALLOCATION OF BOND INVESTMENTS BASED ON RATING

Investment choices by alternative fixed income funds

The survey then examined managers’ allocations through the various segments of the bond market. Government securities attracted the lion’s share of investments (24.6%, see chart 3), followed by investment-grade corporate bonds (22.7%), and high-yield bonds (18.6%). Structured securities such as ABS, MBS and CDO (13.1%) and emerging bonds (7%) also attracted a significant share. Liquidity was 10.4% and the derivative securities used for coverage amounted to -3.4%. If we shift the focus to the rating of the bonds in the portfolio, we find that “AAA” securities top the list with 31.5%, followed by “BBB” (19.7%), “AA” (15.3%) and “BB” bonds (13.9%). Investment in “A” and “B” securities was lower, at 9.6% and 5.9% respectively. (see chart 4).

In addition, the analysis of duration showed a relatively limited average value, of 1.54 years, with 21.4% of funds showing a negative figure, 35.7% between 0 and 1 year and 21.4% between 1 and 3 years, and 21.4% opting for more than 3 years.

Harvey says he prefers high-yield bonds, but is careful to limit duration on American securities. “On the long side of the portfolio, we remain positive on high-yield with respect sto investment grade bonds, because the former should prove more resilient in a context of increased interest rates. At individual country level, the United States are offering interesting opportunities from a relative value perspective, considering the higher yields they provide.

In recent weeks we have also seen significant issues in Europe by American companies, to exploit the possibility of low-cost refinancing not accessible on the domestic market. As we approach the first rises by the Fed, however, we prefer to adopt low-duration positions in US fixed returns products. On the currency front, our view of the Australian and New Zealand dollars is negative since the weakness in raw materials prices will probably persist”.

In Kuhnke’s view, “Italian and Spanish government bonds, like corporate bonds, should out-perform their German and French equivalents, while we expect positive performances from high-yield bonds. Based on our analysis, currency exposure is managed in a discretionary manner. As we expect the upwards trend of the dollar against the euro to continue, we are holding a long position in dollars that equates to 10% of the portfolio”.

Lastly, Mariotti explains the strategy currently adopted by his fund: “We are short in duration (less than 2 years at present). And we achieve that by combining traditional (special situation) short-term liquidity investments with interesting investment opportunities, especially in the high yield and Italian subordinates segment that is no longer compliant with Basel III.

This type of instrument has very close call dates that make it possible to limit exposure to any rises in interest rates, but which require careful in-depth analysis of the fundamentals and of the financial statements. As regards currency exposure, we have managed to grasp most of the potential created by the stronger dollar. At current levels, we have decided to neutralise exposure in dollars (about 10%) by covering it completely, so as to remove a possible element of volatility”, concludes Mariotti.

The contents provided for in this section have not been audited by independent bodies. There’s no warranties, expressed or implied, regarding reliability, accuracy or completeness of the information and opinions contained. The informations provided are not based on assessment of the adequacy and do not consider the risk profile of the possible recipients, and therefore, should not be construed as personal recommendation and does not constitute investment advice. The contents of this site may not be reproduced and/or published whole or in part, for any purpose, and/or disclosed to third parties.