Dawid Krige, Banor Capital adviser, predicts growth in domestic consumption, while rising US interest rates won’t have a major impact.

Read the full article below.

There’s still room for growth for high quality Chinese equity selected using a value approach

Dawid Krige, Banor Capital adviser, predicts growth in domestic consumption, while rising US interest rates won’t have a major impact.

By Valerio Magni

High quality Chinese equity, especially shares listed in Hong Kong and the United States, still has significant potential to rise. While the reforms put in place by the Chinese government could bring the future growth rate to between 5% and 7%, “they will be positive for increased domestic consumption and will enable a more efficient allocation of capital”. This is the view of Dawid Krige, Banor Capital Adviser for the Banor SICAV Greater China Long Short Equity fund, interviewed for MondoAlternative.

1. There is a lot of discussion regarding the impact that a rise in US interest rates could have on the emerging markets. What would be the effects on the Chinese economy and on the valuations of Chinese equities? Rising US interest rates won’t have a major impact on either the Chinese economy or on Chinese financial markets. Unlike the US, China’s monetary policy has been quite restrictive in recent years, but that has started to change recently. Looser monetary policy could provide a tailwind for both its economy and for its equity markets over the next few years.

2. What are your expectations about the growth of Chinese GDP in 2015 and in the medium term? We expect growth to moderate from its historical 8-10% to 5-7% per annum over the next few years, driven by consumption, urbanization and productivity gains. Contrary to popular opinion, a lower growth environment might actually prove to be a benign environment for equity investors, as companies are more likely to be focused on generating free cash flow than before.

3. What are the most significant reforms implemented by the Chinese government, what are your expectations in the next year or two and what are the sectors or companies that will benefit most? We are positive about the new Chinese leadership’s reforms. State-owned companies will be made more shareholder-friendly and 100m migrant workers will be provided with healthcare and other social benefits. Other major reforms include the liberalizing of interest rates and the opening up of certain parts of the economy to private capital. Generally speaking, these reforms will be positive for domestic consumption and allow for capital to be more sensibly allocated in future.

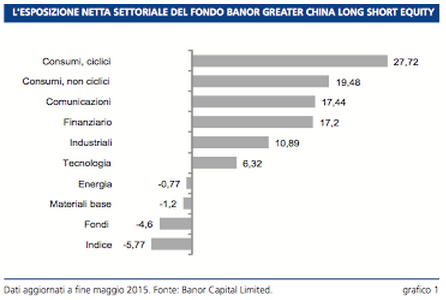

4. Since Chinese markets opened up to foreign investors, there has been a remarkable equity market rally. What are the opportunities and risks of investing there now? We still see significant upside potential in our portfolio of high quality names trading at attractive valuations. We see value especially amongst companies listed in Hong Kong and the US. The Greater China Long Short fund has a significant bias towards domestic consumption: about one-fifth of the fund is invested in financial services, one-fifth in internet companies, and one-fifth in consumer staples. Smaller high-growth companies listed in the A-share market do not offer sufficient margins of safety at present.

5. What is your investment approach to the Chinese market? We call our investment philosophy Quality Value. It is very simple: we buy great companies when they are significantly undervalued. A great company is one with durable entry-barriers, and honest and capable management. There are relatively few companies in Greater China that meet our criteria: our target universe is about 150 companies out of a total of 5,000 or so companies we could invest in. Of these 150, we typically own around 20 that are undervalued based on their forecasted cash operating earnings. We are essentially applying Warren Buffett’s investment principles in Greater China.

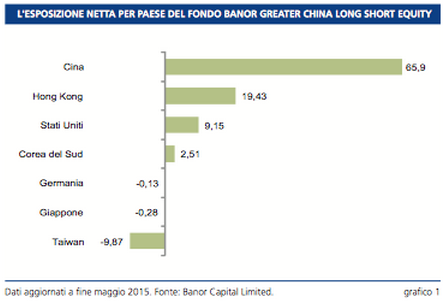

NET EXPOSURE BY COUNTRY FOR BANOR’S GREATER CHINA LONG SHORT EQUITY FUND

Data at end-May 2015. Source: Banor Capital Limited.

6. What are the themes that have worked out best so far, and which ones have not worked out, in your portfolio during 2015? Our investments in financials and companies that have been hit by the anti-corruption campaign, such as the high-end spirits companies Kweichow Moutai and Wuliangye, have performed strongly recently. Names that have been under a bit of pressure include our exposure to retailers such as Luk Fook, the Hong Kong jeweller.

7. How do you usually manage gross and net exposure on the portfolio? What sort of financial tools do you adopt in order to take a short position on single names, and/or the market as a whole? The fund’s net exposure has been reasonably stable over the past year at roughly 80%, as we continue to find lots of great ideas in this under-valued and under-owned asset class. Shorts are a combination of shares (through equity swaps on low quality companies with dubious management and/or financials) and index futures.

NET SECTORIAL EXPOSURE OF THE GREATER CHINA LONG SHORT EQUITY FUND

Data at end-May 2015. Source: Banor Capital Limited.

Read the article (italian pdf file) here: MondoAlternative, May 2015.

The firm

Banor Capital Limited is an independent investment management firm based in London. Banor was created in 2011 by a team of investment professionals working together since 2001. Banor’s goal is to be the partner of choice for institutional and private clients looking for a value-based investment manager. Banor Capital Ltd (UK), together with its sister companies Banor SIM S.p.A. (Italy) and Banor SICAV (Luxembourg), is part of a management-owned group whose sole focus is to provide the highest standards in investment management solutions.

The group’s assets under influence (AUI) are in excess of €4.2bn, of which €1.8 bn are under discretionary management. Banor SICAV is the group’s flagship UCITS IV umbrella fund with five sub-funds: three alternative long/short strategies (North America, Italy and Greater China), one equity (European Value) and one fixed income (Euro Bond Absolute Return).

The contents provided for in this section have not been audited by independent bodies. There’s no warranties, expressed or implied, regarding reliability, accuracy or completeness of the information and opinions contained. The informations provided are not based on assessment of the adequacy and do not consider the risk profile of the possible recipients, and therefore, should not be construed as personal recommendation and does not constitute investment advice. The contents of this site may not be reproduced and/or published whole or in part, for any purpose, and/or disclosed to third parties.