Francesco Castelli, portfolio manager Banor Capital, is quoted in a Bloomberg Business article about italian savers and bank bonds.

Read the full article below.

Italian Savers Wake Up to Risk in $230 Billion of Bank Bonds

by Tom Beardsworth and Sonia Sirletti

Italian banks may no longer be able to count on a key source of low-cost funding — their own customers. Local savers, who hold about 200 billion euros ($230 billion) of bank bonds, are slowing purchases partly because of rule changes that will increase the risk of notes being written down if a bank gets into difficulties. Financial troubles at three lenders may also highlight the possibility of bail-ins to bank customers, who have tended to treat bonds like high-yield deposit accounts rather than risky subordinated debt.

“Customers will not only stop purchasing bank bonds — they’ll try to sell bonds they already own,” said Mauro Novelli, national secretary of Adusbef, a consumer group that has campaigned against the rule changes. “Italian savers will face too much risk with the new bail-in rules.”

Writing down bonds at failing banks will be easier to do from January, when new bail-in tools come into force in Italy under changes mandated by the European Union’s Bank Recovery and Resolution Directive, or BRRD. That’s increasing risk of creditor losses at the three financially stricken lenders, which have about 900 million euros of outstanding subordinated notes.

“If there’s a bail-in, this will change behavior,” said Francesco Castelli, a London-based portfolio manager at Banor Capital, which oversees 4.2 billion euros of assets, including Italian bank bonds. “Banks could find it more difficult to fund themselves through retail investors.”

The troubled lenders — Banca delle Marche SpA, Cassa di Risparmio di Ferrara SpA and Banca Popolare dell’Etruria e del Lazio — are all being run by government-appointed administrators. Banks have to be put into resolution before a senior bond bail-in becomes possible. It would also only happen after the lender failed to raise money privately and turned to rescue funds.

Nationwide, there has been a “significant contraction” in retail bank-bond sales, the Bank of Italy said in May. The central bank warned savers about how BRRD would increase bond risks in a rare notice to the public in July. It also said banks should explain these dangers to customers and suggest safer alternatives, such as certificates of deposits covered by an industry-backed guarantee fund.

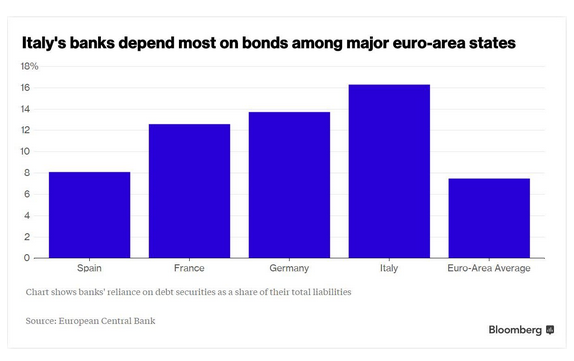

The retail slowdown could drive up lenders’ funding costs, as bonds make up 16 percent of Italian banks’ total liabilities, more than double the average for euro-zone countries, based on European Central Bank data. The higher costs may help government efforts to promote consolidation in the nation’s fragmented banking industry, Castelli said.

Retail investors held 203 billion euros of bank bonds in March, or about 5 percent of household savings, based on Bank of Italy data. Demand was fueled by tax changes a decade ago that cut returns on certificates of deposits, according to Michael Immordino, a partner at law firm White & Case.

Bond Returns

Gross annual interest rates on five-year certificates of deposits are now about 1 percent. By contrast, Mediobanca SpA is guaranteeing at least 3 percent in a 500 million-euro sale of 10-year subordinated Tier 2 floating-rate bonds. The bank’s 497 million euros of junior notes maturing April 2023 yield about 3.5 percent, prices compiled by Bloomberg show. Mediobanca noted the risks from the BRRD bail-in rules in its bond-sale prospectus.

Still, whether unsophisticated retail savers really understand bond risks largely depends on the explanations they get from staff in banks’ branches, said Angelo Drusiani, an adviser at Milan-based private bank, Banca Albertini Syz. “History shows that Italians invest their money where they are told to,” he said.

The contents provided for in this section have not been audited by independent bodies. There’s no warranties, expressed or implied, regarding reliability, accuracy or completeness of the information and opinions contained. The informations provided are not based on assessment of the adequacy and do not consider the risk profile of the possible recipients, and therefore, should not be construed as personal recommendation and does not constitute investment advice. The contents of this site may not be reproduced and/or published whole or in part, for any purpose, and/or disclosed to third parties.